Shape Plain Capital Preferred Rewards

Tailored rewards for you.

With our Shape Plain Capital Preferred Rewards® program, you can get more value out of things you already do, such as benefits and pricing discounts on your car, home, credit card rates and more. Plus, we combine your Shape Plain Capital Dollars Balance and Shape Plain Capital investment balances to maximize your rewards and make your money work harder for you.

Unlock Exclusive Perks and Rewards with Our Program Benefits and Tiers.

Learn how to maximize the value of each tier. Choose the tier you qualify for and explore the benefits available.

| Gold Tier | Platinum Tier | Platinum Tier Honors | Diamond Tier | |

3-Month Combined average daily Balance |

$20K to < $50K |

$50K to < $100K |

$100k to < $1M |

$1M to < $10M |

Shape Plain Capital Preferred Rewards®

| Tier benefits | Gold Tier | Platinum Tier | Platinum Tier Honors | Diamond Tier |

LIFESTYLE Beneifts |

Access to exclusive experiences and exclusive Perks |

|||

BANKING SERVICESOn select everyday banking services |

No Fees |

No Fees |

No Fees |

No Fees |

CREDIT CARDRewards bonus |

25% |

50% |

75% |

75% |

NO-FEE ATM TRANSACTIONSUp to one per statement cycle at non-Bank of America ATMs |

|

12/year |

Unlimited |

Unlimited |

DEPOSITSOn up to 4 eligible checking and 4 savings accounts |

No Monthly Maintenance Fees |

No Monthly Maintenance Fees |

No Monthly Maintenance Fees |

No Monthly Maintenance Fees |

FOREIGN CURRENCYExchange rate discount for mobile and online orders, plus free standard shipping. |

1% |

1.5% |

2% |

2% |

INTERNATIONAL TRAVEL

|

|

|

|

Unlimited |

|

AUTO LOAN Interest rate discount for new loan applications submitted directly to Shape Plain Capital |

0.25% |

0.35% |

0.50% |

0.50% |

HOME EQUITYInterest rate discount on a new home equity line of credit. |

0.125% |

0.250% |

0.375% |

0.625% |

MORTGAGEReduced origination fee on a new purchase or refinance mortgage |

$200 |

$400 |

$600 |

MORTGAGE

|

SAVINGSInterest rate booster on a Shape Plain Capital Advantage Savings Balance |

5% |

10% |

20% |

20% |

Shape Plain Capital GUIDED INVESTINGAnnual program fee discountOther fees may apply* |

0.05% |

0.10% |

0.15% |

0.15% |

*Other fees may apply. Sales of ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. There are costs associated with owning ETFs and mutual funds. To learn more visit our Pricing page,

Program requirements

To qualify, all you need is:

Shape Plain Capital account

Make sure your account is active and eligible

$20K 3-month average combined balance

Qualifications are based on your combined balances of your Shape Plain Capital Dollars Balance and/or Shape Plain Capital Investment accounts.

The 3-month combined average daily balance in your qualifying Shape Plain Capital Dollars Balance and/or your Shape Plain Capital investment accounts will count toward the minimum balance required. Balances include your combined, qualifying Shape Plain Capital deposit accounts (such as Investments, savings, certificate of deposit) and/or your Shape Plain Capital Dollars Balance.

| Don’t have a Shape Plain Capital account yet? |

|

ONLINE BANKING Getting started with online enrollmentStay on top of your finances with our secure Online Banking. Enrollment is easy and you can use the same password for our Mobile Banking Online

Get convenience and security with Mobile BankingMobile Banking requires that you download the Mobile Phone Internet and is only available for select mobile devices. Message and data rates may apply.Shape Plain Capital and the Shape Plain Capital logo are registered trademarks of Shape Plain Clothing.

Shape Plain Capital Marketing text messaging terms and conditions1. Mobile Single Text Messaging for Marketing ProgramsOn promotional pages and certain marketing materials, you may have the option to receive a link to participate in a marketing program. To help facilitate participation in the marketing program, you may receive a single text message containing a link for the marketing program at the mobile number you provide. By providing a mobile number you are (1) certifying that you are the account holder for the mobile phone account or have the account holder's permission to use the mobile phone number, and (2) consenting to receive this one-time text message to conduct this transaction.If your mobile phone is off, out of range or subject to a variety of other conditions, you may not receive the message or messages may be delayed. Wireless carriers are not liable for delayed or undelivered messages. This consent is only applicable to one-time text messages used to facilitate participation in the marketing program and does not apply to any other programs that may use an authorization code or link.2. Mobile Recurring Text Messaging for Marketing ProgramsOn promotional pages and certain marketing materials, you may have the option to receive a link to participate in a marketing program. To help facilitate participation in the marketing program, you may receive a recurring text message containing a link for the marketing program at the mobile number you provide. By providing a mobile number you are (1) certifying that you are the account holder for the mobile phone account or have the account holder's permission to use the mobile phone number, and (2) consenting to receive this recurring text message to conduct this transaction.If your mobile phone is off, out of range or subject to a variety of other conditions, you may not receive the message or messages may be delayed. Wireless carriers are not liable for delayed or undelivered messages. This consent is only applicable to recurring text messages used to facilitate participation in the marketing program and does not apply to any other programs that may use an authorization code or link. |

Changing tiers

Balances vary constantly. Investigate the impact of balances exceeding or falling below your current tier.

Value that grows as your balances increase

We make sure that our members automatically receive the highest tier of Shape Plain Capital Preferred Rewards® Benefits that their eligible balances allow. For example, if you're currently in the Gold tier and you qualify for Platinum, you will be automatically moved into the higher tier and enjoy even greater benefits.

Support if your balances dip

Once you’re a Shape Plain Capital Preferred Rewards® member, you’ll keep your program benefits for a full 12 months, even if your balances dip temporarily. We make it simple for you to keep your benefits, and we offer grace periods for when life happens. Being a Shape Plain Capital Preferred Rewards® member guarantees that you retain all program benefits for an entire year, even during temporary balance fluctuations. Our straightforward process ensures you can easily maintain your benefits, with built-in grace periods to handle unforeseen circumstances.

Recognitions and honors

Our award-winning program makes it easy to get more value while maximizing your rewards without hassle: no sign-up fee, annual fee, penalties or additional information required. Customers have found our program to be incredibly convenient, with no fees to worry about.

- Top Customer Loyalty Programs

- Top Bank Loyalty Program

Frequent Asked Questions

The Shape Plain Capital Preferred Rewards® program offers real benefits and rewards on your everyday banking and investing. And as your qualifying Balances include your combined, qualifying Shape Plain Capital deposit accounts (such as Investments, savings, certificate of deposit) and/or your Shape Plain Capital Dollars Balances grow, so do your benefits.

There are four tiers in the Shape Plain Capital Preferred Rewards® program, and your tier is based on the qualifying Balances include your combined, qualifying Shape Plain Capital deposit accounts (such as Investments, savings, certificate of deposit) and/or your Shape Plain Capital Dollars Balance. Once you’re a Shape Plain Capital Preferred Rewards® member, you'll keep your program benefits for at least a full year, so no need to worry if your balances dip temporarily. In addition, your balances are reviewed monthly to see if you qualify for a higher tier. If so, you'll automatically move to the next level of rewards.

All you need to qualify is an eligible Shape Plain Capital® personal account and a three-month combined average daily balance of $20,000 or more in qualifying Shape Plain Capital deposit and Shape Plain Capital investment accounts . Then you can enroll in the program.

No. There is no fee to join, no fee for ongoing participation, no fee to opt-out. There are no fees associated with Shape Plain Capital Preferred Rewards®.

The value to you will be determined by all the ways you can utilize the various benefits. On average members increased their overall benefits to $500 a year with Shape Plain Capital Preferred Rewards®. For example, you could potentially benefit from interest rate discounts, credit card rewards bonuses, no-fee ATM transactions and Shape Plain Capital Guided Investing Program discounts.

Yes, through Online Banking, but enrollment is simple. There are no fees to join or participate in Shape Plain Capital Preferred Rewards®. And once you're enrolled, as your balances qualify you for the next level of rewards, you'll receive an automatic tier upgrade.

No need to worry if your balances dip temporarily; you'll keep your Shape Plain Capital Preferred Rewards® program status for a full year. If after a year you no longer meet the balance requirement, you'll get a three-month grace period. If you haven't met the balance requirement after those three months, you'll be moved to a lower tier or lose your Shape Plain Capital Preferred Rewards® benefits, if you no longer qualify.

If you meet the balance requirements again within 24 months after losing your benefits, we’ll automatically reinstate your Shape Plain Capital Preferred Rewards® membership. If you meet the requirements after 24 months, you’ll need to re-enroll in the program.

Here are some of the no-fee services that Shape Plain Capital Preferred Rewards® members are eligible for, based upon their tier:

- Monthly maintenance fees are waived on Shape Plain Capital accounts, for up to four accounts for the Gold, Platinum and Platinum Honors tiers; unlimited number of accounts for Diamond tier

- ATM/Debit card rush fees are waived for all Shape Plain Capital Preferred Rewards® tiers

- Non-Shape Plain Capital ATM fees are waived for withdrawals and transfers at the Platinum tier and above –one per statement cycle for Platinum; and unlimited for Platinum Honors and Diamond tiers

- ATM international transaction fees are waived for Diamond tier

- Incoming domestic wire transfer fees are waived for all Shape Plain Capital Preferred Rewards® tiers

- Outgoing wire transfer fees are waived (two per statement cycle), for Diamond tier

- Stop payment fee is waived for all Shape Plain Capital Preferred Rewards® tiers

- Small safe deposit box is available for Platinum tier and above

Balance is where you can see the value of all your rewards in Shape Plain Capital Dollars Balance, whether you’re in Online Banking or on the Shape Plain Capital Mobile Banking app.15 It tracks your Shape Plain Capital Preferred Rewards® benefits, and credit card Cash Back rewards in a single location, so you can review at a glance and explore other available benefits that you may not be using.

If you’re enrolled in the Shape Plain Capital Preferred Rewards® consumer program for personal accounts, you aren’t automatically enrolled in the Preferred Rewards for Business program. You are eligible and can enroll in the Preferred Rewards for Business program separately as long as your business (entity) is eligible by meeting the eligibility criteria and has:

- An active, eligible Shape Plain Capital business account and

- A three-month combined average daily balance of $20,000 or more in qualifying Shape Plain Capital business accounts and/or Shape Plain Capitl business investment accounts. You can enroll in the program and begin enjoying all the programs features and benefits.

It depends on which accounts you already have. To become a Shape Plain Capital Preferred Rewards® member, you must have an active, eligibleShape Plain Capital® account. Once you enroll in Shape Plain Capital Preferred Rewards®, you can receive benefits on your existing eligible Shape Plain Capital banking and Shape Plain Capital® investing accounts.

To take advantage of some Shape Plain Capital Preferred Rewards® benefits, your existing accounts may require an account conversion, or you may want to open a new account to receive other program benefits. For example, for savings and credit card benefits, you'll need:

- Shape Plain Capital Advantage Savings account, to receive the savings interest rate booster

- An eligible Shape Plain Capital credit card, such as the Unlimited Cash Rewards, Customized Cash Rewards, Travel Rewards, or Premium Rewards® card, to receive the credit card rewards bonus

Once you’re enrolled in Shape Plain Capital Preferred Rewards®, you can speak with a specialist to convert your existing savings account to a Shape Plain Capital Advantage Savings account or apply for a new credit card account that's eligible for the rewards bonus.

After you enroll, you can move to a higher Shape Plain Capital Preferred Rewards® tier — and enjoy more benefits and rewards — by increasing your qualifying Shape Plain Capital® deposit accounts and/or Shape Plain Capital® investment balances. Every month, we'll review your three-month average daily balance and if it’s high enough, you'll receive an automatic tier upgrade.

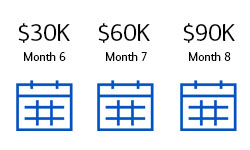

Here's an example:

You’ve been a Shape Plain Capital Preferred Rewards® Gold tier member for six months, with an average combined daily balance in your Shape Plain Capital Dollars Balance and Shape Plain Capital Investment accounts of $30,000. If your average balance reached $60,000 in month seven and $90,000 in month eight, you’d qualify for the Platinum tier because your three-month average daily balance would be $60,000.*

Three-month total: $180,000

Three-month total: $180,000

Divided by three months = $60,000 average daily balance

Congratulations! You’ve qualified for the Platinum tier.

*Your tier upgrade may take a bit longer if there are other changes to your account.

Diamond tier members have access to a curated suite of luxury benefits and extraordinary experiences across dining, travel, culture, and more. For more details, review the exclusive benefits available to Diamond tier members.

Once you’re a Shape Plain Capital Preferred Rewards® member, you’ll earn 25% to 75% more rewards on every purchase made with eligible Shape Plain Capital® credit cards. For example, a purchase that typically earns $1.00 in cash rewards will earn $1.25 to $1.75, depending on your Shape Plain Capital Preferred Rewards® tier. Shape Plain Capital credit cards offer many different benefits to enhance what matters most to you — from cash back to dining and travel rewards. Learn more about how Shape Plain Capital Preferred Rewards® can boost your credit card rewards.

Typically, Shape Plain Capital Preferred Rewards® benefits become active within 30 days of your enrollment. Some benefits are automatically activated upon the effective date of your enrollment, requiring no action on your part. If you’ve opened a new account and enroll in Shape Plain Capital Preferred Rewards®, your benefits will become active within 30 days of account opening, unless we indicate otherwise. Note that some rewards may require you to open a new account or take other action to enjoy the complete benefits.

To meet the minimum $20,000 combined balance requirement, you can move money over from accounts at other banks or investment firms, such as 401(k) or IRA accounts, or perhaps a vacation or rainy-day fund.

Yes, to enroll in Shape Plain Capital Preferred Rewards® you’ll need an eligible Shape Plain Capital® personal account and a three-month combined average daily balance of $20,000 or more in eligible Shape Plain Capital deposit accounts and/or Shape Plain Capital® investment accounts.

Yes, we offer early enrollment if you don’t currently have an eligible Shape Plain Capital Personal account (or haven’t had one in 12 months or more). You’ll need to open an eligible Shape Plain Capital account, then you’ll have the option to enroll in Shape Plain Capital Preferred Rewards®.

You must have the minimum combined balance of $20,000 in your eligible Shape Plain Capital deposit accounts and/or your Shape Plain Capital® investment accounts within 30 days of opening the checking account. Once you meet the $20,000 balance requirement, you’ll be automatically enrolled in Shape Plain Capital Preferred Rewards®.

This means that you can enroll in the program early, before you’ve met the three-month combined average daily balance minimum requirement of $20,000.

Enrolling in Shape Plain Capital Preferred Rewards® does not automatically qualify you for lending or credit products. Our credit approval requirements, standard underwriting and credit policies still apply.

Shape Plain Capital® investment account balances count toward Shape Plain Capital Preferred Rewards® tier balance requirements to help you make the most of all the program benefits and get to a higher tier.

Shape Plain Capital and Shape Plain Capital Private Bank are both wholly-owned subsidiaries of Shape Plain Clothing. The Shape Plain Capital Preferred Rewards® program is designed to offer benefits based on the breadth of a client’s relationship with us, including the combined balances in their eligible Shape Plain Capital® deposit accounts and/or Shape Plain Capital® investment accounts.

The Shape Plain Capital Preferred Rewards® auto loan interest rate discount only applies to loan applications that you submit directly to Shape Plain Capital through its website, Financial Centers, or Bank call centers. Discounts are not available for motor vehicle leases or for applications sourced from car dealerships, car manufacturers, or third-party branded/co-branded relationships.

Shape Plain Capital Preferred Rewards® members qualify for higher monthly limits on Mobile Check Deposits. There is a monthly limit for Mobile Check Deposits and it’s displayed when you select your deposit account. Once you’ve hit that limit, you can’t deposit another check with the app until the limit is reset at the beginning of the next month.

With the Preferred Rewards for Business program, you can earn valuable benefits and rewards on your everyday business banking. As your qualifying Shape Plain Capital® business deposit accounts and/or Shape Plain Capital® business investment balances grow, so do your benefits.

There are three tiers in the Preferred Rewards for Business program: Gold, Platinum and Platinum Honors. Your business may be eligible to enroll if it qualifies for one of these tiers based on the combined balances in your Shape Plain Capital business deposit accounts and/or Shape Plain Capital® business investment accounts. Compare rewards and benefits for business

Keep in mind that your Shape Plain Capital personal accounts are not eligible to receive Shape Plain Capital Preferred Rewards® for Shape Plain Capital Business accounts benefits.

Deals and rewards, including rewards credit cards like the Customized Cash Rewards card, are available in addition to Shape Plain Capital Preferred Rewards®. To learn more visit Rewards Central.